All rights reserved.

Chinese platforms differ significantly from how a large part of the livestreaming services operate in terms of their target audiences, global availability, and how they calculate their viewership figures. This is especially true when compared to names that are popular in the Western world, such as Twitch, YouTube, Kick, and Rumble.

However, with a constantly growing market and a user base that might be among the most active, knowledgeable, and tech-savvy, livestreaming platforms in the powerhouse Central Asian nation remain in demand, which means high local competition. This is magnified tenfold as native services rule the roost thanks to the laws of the land, which means that these companies calculate metrics differently from how their Western counterparts do.

Also read: Inside China's gaming livestream scene: What the Heat Index reveals

Some of the top names that might come to mind are DouYu, Huya, Douyin (Chinese TikTok), and Bilibili. Each of these livestreaming services offers something different and uses distinct methods to calculate their audience numbers, which is where the database of DoHuya comes into the picture.

DoHuya, which delves into Chinese streaming analytics, maintains a record of all data and key statistics from channels, games, and livestreams on DouYu, Huya, Bilibili, and CC163 platforms. As a result, we can collate a few rankings based on the metrics used in China, like Peak Heat Index and Average Heat Index.

In China, livestreaming platforms don't show concurrent viewer counts like Twitch or YouTube. Instead, they use a proprietary Heat Index (often called "heat" or "popularity index"), a composite signal that blends multiple engagement factors (broadcast duration, channel traffic, virtual gifting, and more) to reflect real popularity. This system helps the algorithms surface rising stars and niche streamers in China's monolingual market, where sheer viewer count alone doesn't equate to visibility. For readers seeking a deeper explanation of how Heat Index works and why it's central to Chinese livestreaming dynamics, we recommend this overview.

With that in mind, here are the rankings for the top categories on the above Chinese platforms in the third quarter of 2025.

On Huya, or Huya Live, the top game by Average Heat Index in the last completed quarter was Honor of Kings. This mobile MOBA enjoys a massive playerbase in China, which, for a long time, was its only market, including in the esports segment.

Other globally renowned games to make this list were League of Legends, PUBG, and Valorant. Interestingly, Game for Peace, essentially a clone of PUBG, has also found a large market in China, with the battle royale arena fighter even earning a higher average Heat Index than Riot Games' highly popular agent shooter.

When it comes to non-gaming content, genres like Make Friends, Star Show, and Outdoor were higher on audiences' priorities on average. With China being a dominant global force, the Sports category also made the top ten, as fans continued to support their teams across disciplines and tournaments.

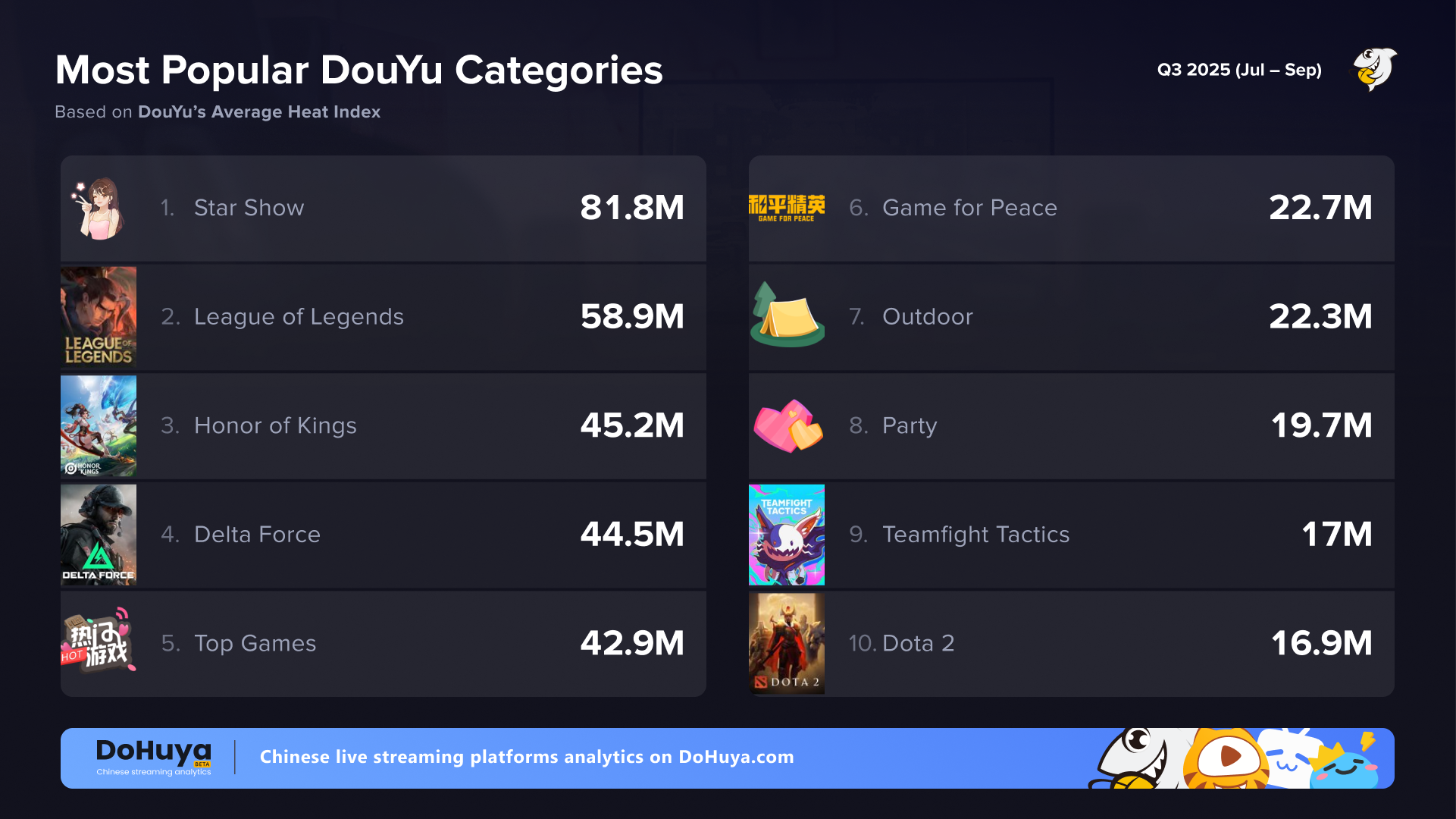

Over on DouYu, the list had a few of the same titles we saw over on rival Huya's top ten, although there were a few additions. Viewers on this platform preferred watching content on video games in Q3 2025, including offerings like Delta Force, Teamfight Tactics, and Dota 2.

Among non-gaming categories, Star Show, Outdoor, and Party made the cut, with the first entry topping the overall charts as well. Interestingly, the top categories on Huya and DouYu did far better than the rest in terms of their Average Heat Index numbers, similar to how Just Chatting/IRL livestreams usually attract the most watch hours on Western platforms like Kick and Twitch because of the sheer volume of creators in the genre.

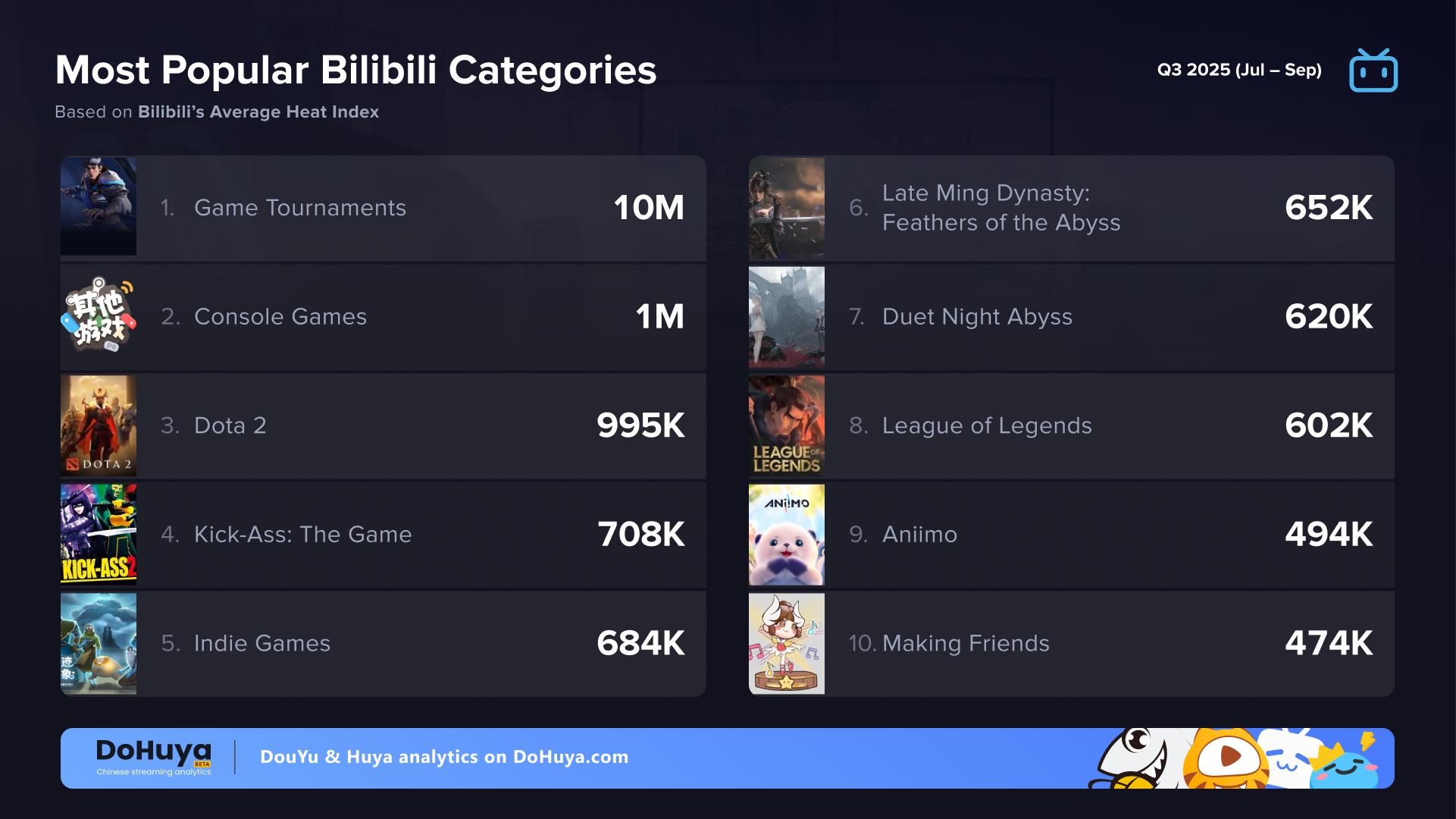

It is well-known that Bilibili, a free video streaming and sharing platform that mostly focuses on anime and television series, has a massive audience base for video gaming. Proof of that was seen on this leaderboard, where almost all the categories with the highest Average Heat Index came from this segment.

The top entry was esports tournaments, of which there was no shortage during the third quarter of 2025. The console gaming category was next, with two massively-popular MOBAs in China — League of Legends and Dota 2 — also making this leaderboard. Valve's legendary offering was undoubtedly helped massively by its world championship, The International, being held in September.

We also had a regional title, Late Ming Dynasty: Feathers of the Abyss, finish in the top ten table. The Chinese-style Cthulhu-like soul ARPG based on ancient Shu civilization, jointly published by Bilibili Games, found a lot of fans among the platform viewers.

Interestingly, most of the games that scored the highest Average Heat Index figures on CC163 were offerings that are a lot more popular in China than among global audiences. Names like Fantasy Westward Journey, New Ghost Story, Positive Energy, NARAKA: Bladepoint, and LifeAfter have all seen success but are undoubtedly more renowned in the Asian video gaming community.

This reiterated the fact that CC163's viewership depends heavily on classic domestic and fantasy franchises. Fantasy Westward is the perfect encapsulation of this point, with multiple versions of this franchise making the above top ten thanks to the fact that they are inspired by the 16th-century Chinese novel Journey to the West.

Chinese platforms continue to set their own standards and cater to the various communities that form a bulk of their audience base in the country. Across the four prominent livestreaming services that DoHuya covers, it is clear that video gaming forms a big part of the country's preferences, while in-real-life (IRL) and vlogs are a more niche choice among streamers and viewers.

Moreover, each platform caters to a specific market, giving audiences more options in terms of the content they can catch up with and what gamers value more. Huya and DouYu focus more on esports broadcasts, CC163 on local fantasy nostalgia, and Bilibili on narrative-driven, immersive story worlds, making it a melting pot of genres that continue to attract thousands of viewers.